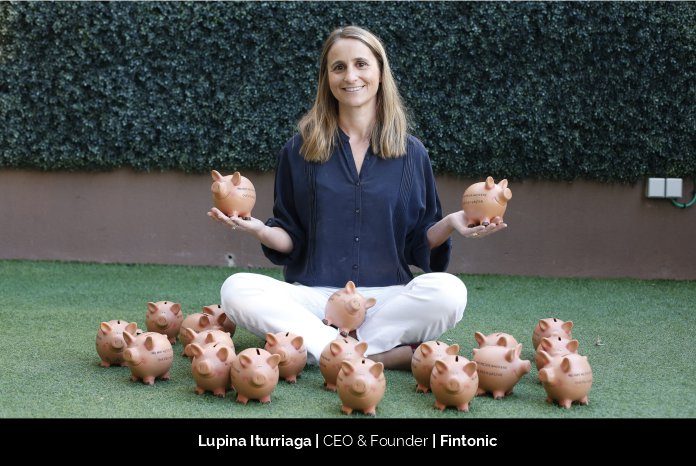

With the spirit to help others, Lupina Iturriaga, Founder and CEO of Fintonic, is transforming the finance industry by bringing an innovative working model. With the core aim to help users gain more value in the financial field, she is leading the way to the top for her business with her partners.

Ladder to success

Lupina completed her Bachelor’s Degree in Business and Administration from CUNEF (Complutense University of Madrid) in 2001 and in the same year she stepped into the banking sector as an Associate with CA Cheuvreux and marked the advent of her professional career.

She adds, “For a time, I worked in the banking sector, focusing on the treasury and commercial banking fields.” But after this, she entered the finance industry with IDEON and became Executive Director and Partner of the firm.

She honed her skills and gained valuable experience. She also expanded her knowledge base by completing a Module within the Master in Finance (Risk Management Module in the Basel II Framework) in 2007 from CUNEF.

Then in 2012, Lupina founded Fintonic to help others by providing smart solutions to ease their life. She states, “The passion for helping people and being truly useful was the concern that drove the creation of Fintonic. I sincerely believe that my greatest achievements are those of Fintonic. I have been very lucky and fortunate to be accompanied by two partners who have made it possible.”

Vision of the company in the transforming industry

Explaining her vision, Lupina expresses, “With more than one million active users, we have acquired a consolidated position in the financial market that allows us to look to the future with optimism. Our model is proven, and, in fact, the transformation of the sector has been marked in many cases by strategies for which we were the first to bet. We are going to continue along the same lines because the user wants the companies to accompany him at the same rate as he evolves and, even, to be able to anticipate his needs.”

With new companies getting into the industry, traditional companies need to amp up their game. By targeting the users’ specific needs, the new players are leading the industry into a new zone.

She adds, “In the case of Fintonic, we can say that being pioneers is in our DNA. We position ourselves at the user’s side, getting and recommending the best for them. It is not wise to just get what one entity pushes you to get. We really believe in the marketplace concept we have developed.”

She states that with new and innovative solutions, they can offer a better user experience and elevate their conversion rate. She focuses the point by highlighting the tool they have developed with their own proprietary technology, the FinScore, a score that evaluates the user’s credit profile, empowering their over 1million active users to understand the interest they deserve when applying for a loan.

By leveraging the technology, they developed the first loan marketplace with which their users get a loan in less than 5 min without paperwork from the top entities in the market.

She adds, “The user also has at his disposal a card to make his payments, with great advantages and can access to the personal financial tools that help them to have all their banks and expenses under control, and also save. We unify in one place all the financial information, and we have created an alert system to warn you of any unforeseen events such as duplicates or erroneous charges, fees, or if you were overpaying, for example, in your receipts, insurances and we help you to do the switch of your receipts without leaving the app. All this with independence and transparency that is engraved in our DNA, always on the user’s side!”

Exhaustive Services of Fintonic

Fintonic mainly resolves all financial needs of the users. Every user gets to use whatever is needed in that instant using the account at the disposal with zero commissions. It enables them to pay hassle-free anywhere using their card be it, physical or virtual. There are different tools to help all the payments as well as expenses in control so that users can save and manage their money efficiently.

Its app helps all users to add the rest of the accounts and cards of other banks within the app. In this way, users get empowered with all information about different financial institutions and companies under one roof. Fintonic also keeps all the user’s money in a structured order and shares on what they spend it on with proper notifications and alerts regarding incorrect or excessive charges, overcharges, etc., so that no one misses on everything.

Besides the FinScore credit profile through FinScore, Fintonic also proffers financing option via its Loan Platform. In just less than 5 minutes, users can easily access the best personalized credit from among 17 entities. It also made sure that users can get access to a fully digital process without any issues of leaving the app.

She adds, “We are also helping people to save effortlessly, for example, by reducing what they pay for their usual bills, such as insurance, telephony, energy. On behalf of the user, Fintonic reviews and renegotiates the conditions that they have contracted and is responsible for obtaining important discounts in the price. Although it may seem incredible, the average savings among users whose insurance policies we have reviewed has been over 400 euros per year, in the case of telephone and energy, the savings are around 250 euros.”

Balancing the roles of CEO and home

Being passionate about work, she always delivers the best. Even the team comprises of young and creative people. She shares, “I think motivation, team feeling and the spirit of improvement are very important. I try to make them become the maxims of my day-to-day life and serve as inspiration so that we all look for opportunities for improvement.”

When prioritization happens, there is no turning back. She says, “The worthiness is not a question of gender, fortunately there are more and more examples of great women who are changing the world in the social, political, cultural sphere.”

She adds, “I have three children and I always say that Fintonic is the fourth. The key to maintaining balance is organization and knowing how to give everything at the right time. Once I leave my children at school, I enter the Fintonic world and I am 100% focused on it.” When she is with her family, she enjoys a lot together with all family members and make it a quality time.

For future, Fintonic team is all set to launch the “Siempre Positiva” account and card to work on new projects. The best part is that they have never really stopped doing it.