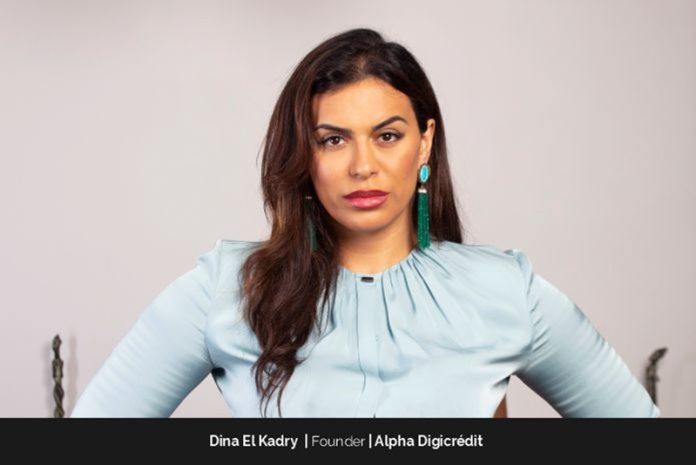

Dina El Kadry’s journey from a high-ranking banking executive to the founder of Alpha Digicrédit is a testament to her ability to recognize opportunities and pivot at the right moment. As a Real Estate Credit Director at CBAO ATTIJARIWAFA BANK, she had already built a strong foundation in finance, but she knew there was more to explore. “After several interesting functions at the bank, it was the right moment for me to make a switch,” she reflects. The shift came with a clear vision: to leverage her expertise and create a holding focused on three key areas: communication, real estate, and finance. This initial success led Dina to refine her focus further, narrowing it down to real estate and finance as the COVID-19 pandemic began.

Alpha Digicrédit emerged as a groundbreaking concept, merging the worlds of PROPTEC and FINTECH into a seamless experience. Dina explains, “Alpha enables you to choose your dream house and make it a reality from the comfort of your sofa in just a few clicks.” Combining real estate and financial brokerage under one digital platform, Alpha Digicrédit is revolutionizing how people approach home buying, offering a level of convenience and accessibility that is truly ahead of its time.

Bridging the Gap: Alpha Digicrédit’s Bold Solution to Senegal’s Housing Crisis

As Dina delved into Senegal’s housing crisis during her tenure as a Technical Advisor to the Presidency, one question kept surfacing: How can a nation with a 350,000-home deficit and a demand that outstrips supply year after year close the gap? Producing just 5,000 homes annually against a need for 15,000, the challenge was clear and demanded an innovative solution. As Armstrong Williams aptly noted, “Real Estate provides the highest returns, the greatest values, and the least risk.” This stark reality inspired Dina to create Alpha Digicrédit.

With her deep expertise in finance and real estate, she envisioned a platform to break down the barriers to home ownership, offering a streamlined, accessible path for citizens across Senegal. Alpha Digicrédit wasn’t just about selling homes. It was about reshaping how people accessed them.

A Personal Mission: Democratizing Access to Housing in Senegal

Dina’s unique vision and mission have earned her a well-deserved spot among the “Top 10 Empowering Women Leaders of 2024.” Her personal experiences transformed her into a catalyst for change, igniting a spark of hope and prosperity in the hearts of Senegalese communities.

At just 24, she was at tough juncture as a divorced woman navigating the struggles of being a single mother to three children. She was searching for stability and security. Over time, this personal goal turned into a deep, guiding force in her career. After juggling running a restaurant and returning to university, she emerged at the top of her class, propelling herself into the world of finance. As she rose to become Real Estate Mortgage Director at ATTIJARIWAFA BANK, a turning point came when she secured a mortgage to buy her first home.

She recollects, “My own property gave me freedom, independence and the feeling that I was powerful.” This empowering experience sparked a flame within her to help others achieve that same empowerment through homeownership. To Dina, democratizing access to housing is not merely a business endeavor. It’s a heartfelt mission to offer others the stability and strength that changed her life.

Overcoming Obstacles: A Path to Digital Real Estate Revolution

To establish Alpha Digicrédit, the first digital real estate credit platform on the African continent, Dina embarked on an innovative path. However, her trail was not without its hurdles. As a neophyte in the tech domain, she had to immerse herself in the complexities of computer science, bridging the gap between her domain expertise and the digital world.

Forming partnerships with banks proved to be another uphill battle, as traditional financial institutions often perceived her as a disruptor rather than a collaborator. Securing investments was equally challenging, as investors and business angels were hesitant to back an unconventional venture. Undeterred by these setbacks, Dina channeled her resilience and determination, self-funding the project and tirelessly advocating for the value proposition of her ingenious platform.

Conquering Housing Conundrums in Senegal: Dina’s Insights from Alpha Digicrédit

Dina highlights how Alpha Digicrédit takes proactive steps to dismantle the three primary barriers to accessing housing: the availability of quality real estate, access to financing, and social and financial education.

Regarding providing access to quality real estate, she explains that Alpha Digicrédit not only curates the best opportunities available on its platform but also ensures they are trustworthy. This approach offers 360° visibility on services, resulting in a fair competition that naturally encourages the market to adopt greater price transparency. As George A. Moore wisely noted, “A man travels the world over in search of what he needs and returns home to find it.” Alpha Digicrédit is dedicated to helping individuals in Senegal both locals and investors as well as those in the Diaspora, find the homes they desire in their own country.

Explaining access to financing, the senior executive educates that each bank’s loan conditions and documentation requirements differ significantly, along with variations in commercial language and service. She highlights the lengthy delays in granting loans, which average between three to six months before clients receive loan notifications. However, she points out that Alpha secures uniform conditions with all the banks, simplifying the documentation process. From the typical three to six months, Alpha manages to provide loan notifications in just 15 days. Clients can track the progress of their applications in real-time through their personal spaces on the digital platform.

Furthermore, Alpha offers customers very competitive interest rates by fostering competition among partner banks. Dina emphasizes that Alpha’s account managers act as comparators and advisors in preparing loan applications, highlighting their advantages and anticipating any potential remarks from banks. This understanding of the system allows them to defend loan applications and secure preferential terms for clients.

In terms of social and financial education, Dina mentions that Alpha creates algorithms that adapt to the socio-professional profiles of their targets, along with the conditions set by all banks. This innovation includes a simulator that provides instant borrowing capacity assessments and offers guidance on improving loan eligibility.

The Impact of Educational Content on Alpha Digicrédit

Homeownership often feels like a distant dream, shadowed by hidden costs that can catch first-time buyers off guard. As Valerie Fitzgerald of The Valerie Fitzgerald Group puts it, “It’s not about the money, though that’s nice to have. At the end of the day, it’s really about matching the right buyer to the right seller.” Dina highlights that the simulator on Alpha Digicrédit addresses this concern head-on, which factors in notary and insurance fees that can represent around 15% of the acquisition amount. She underscores how these often-overlooked expenses can create significant barriers for new homeowners. To further empower these individuals, she emphasizes that the platform is enriched with educational content, including comprehensive guides designed to simplify the journey to homeownership.

Strategies for Work-Life Integration

Dina has the secret mantra to a fulfilling life. She’s mastered the art of balancing work and play, proving that success doesn’t have to come at the cost of happiness. It’s all about structure and boundaries. She schedules her work time, ensuring she’s productive, but she also blocks out time for self-care and relaxation. And let’s not forget the importance of a strong support system. Dina relies on her team at home and work, allowing her to take breaks and recharge.

But that’s not all. This seasoned executive believes in the power of adventure. She makes time for trips, disconnects from the daily grind, and comes back refreshed and inspired. And she’s even discovered the joy of fitness, realizing that regular workouts significantly boost her energy and mood. That’s why she recently hired a personal trainer to work on her body and mind a few times a week.

Celebrating Success: A Milestone for Alpha Digicrédit

While this dynamic female leader has garnered numerous accolades for her groundbreaking work, the Innovation Award she received from ‘Germany’s First Lady in May 2024’ truly shines. Dina recalls this moment as especially meaningful, with her dad by her side, his pride evident as he discovers the depth of her sacrifices and her impact on the industry.

On top of this recognition, she highlights how Alpha Digicrédit empowers customers to save up to 20% on their monthly payments, all thanks to their advantageous market conditions. These achievements are more than just milestones for Dina; they symbolize her steadfast dedication to reshaping the housing sector and ensuring everyone has an equal opportunity to access affordable housing.

Navigating Challenges as a Woman Leader

In a male-dominated society, women face unique challenges in sustaining their presence and influence, particularly in the tech sector. Dina highlights that women often encounter underestimation when launching new initiatives across various industries, a situation she knows all too well as a pioneer in her field.

Securing funding has been a constant struggle for her, and recent statistics reveal a bleak reality: women are significantly less likely to receive investment compared to their male counterparts, especially in Africa. In response to these obstacles, Dina actively champions women’s empowerment through her involvement in the Women Investment Club in Senegal and as an investor with WIC Capital, an organization dedicated to financing women-led entrepreneurship and startups.

Vision for Alpha Digicrédit in Africa’s Real Estate Sector

The Founder and Executive Director envisions that Alpha Digicrédit will play a pivotal role in the future of the real estate sector in Africa. She states that the company has forged over a hundred partnerships with banks, insurance companies, and notaries, along with over a hundred partnerships with property developers.

Dina underlines that the West African Central Bank accredits Alpha to operate as an intermediary in all banking operations (IOB). Additionally, she shares that the company is collaborating with the Senegalese Ministry of Urban Planning to contribute to developing a policy aimed at improving access to social housing, which she identifies as a significant point of pride for the organization. Looking ahead, this prescient businesswoman expresses hope for expanding this partnership and emphasizes the goal of making an effective contribution to processing applications for the 500,000-housing program.

Advice for Aspiring Women Leaders

As an established and influential business leader, Dina offers invaluable advice for aspiring women leaders in the real estate and tech sectors. She emphasizes that the key to success lies within; it’s an inward journey that unlocks limitless opportunities. These aspirants should carefully study their market and embrace calculated risks. Dina stresses the importance of believing in one’s abilities while surrounding oneself with a skilled team and knowledgeable partners.

She advocates staying ahead of emerging technologies and honing essential sales and interpersonal skills to stand out. Drawing from her experience, Dina identifies key qualities necessary for success in these industries: resilience, determination, confidence, teamwork, empathy, open-mindedness, and strong problem-solving capabilities.

Innovations Driving Change at Alpha Digicrédit

For many Senegalese, the dream of owning their own home remains elusive due to financial constraints. However, Alpha Digicrédit is working to change that by making homeownership more accessible through innovative technology and financial education.

Dina explains that access to bank credit is crucial for first-time buyers in Senegal. They believe one can significantly impact the real estate sector by popularizing credit. This philosophy echoes the timeless wisdom of Will Rogers: “Don’t wait to buy real estate. Buy real estate and wait.”

Alpha Digicrédit’s first technological innovation is a personalized simulator. This unique tool allows potential buyers to determine their borrowing capacity before even starting their property search. Users can see how much they can borrow over a specific timeframe by simply entering details like their date of birth, salary, and current loans. The simulator then compares this figure to a property simulation, factoring in notary fees, loan amounts, and other relevant factors. A dynamic cursor clearly indicates whether their dream home is within reach.

Beyond technology, Alpha Digicrédit is committed to financial education. The platform offers a wealth of resources, including guides, FAQs, and articles, covering everything from insurance and notary services to property loan characteristics and market news. This knowledge empowers users to make informed decisions and avoid common pitfalls.

The veteran concludes that Alpha Digicrédit is a one-stop shop for real estate buyers in Senegal. By combining innovative technology, personalized advice, and comprehensive financial education, the platform is helping to make homeownership a reality for more people.

Envisioning the Future of Alpha Digicrédit

Dina is a visionary who knows how to set her goals much in advance. While destiny plays its fair share of roles, she swears by being a ‘doer.’ Thus, she has a well-outlined agenda for Alpha Digicrédit. She plans to continue advancing its mission and contributing to the broader goal of democratizing access to housing in Senegal and beyond. She underlines, “We plan to expand to other African countries in the next few years.” Dina notes that the real challenge lies in raising the funds needed to scale their activities and expand further to achieve a greater impact.